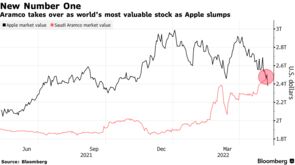

Saudi Aramco Becomes World’s Most Valuable Stock as Apple Drops

- The reversal reflects recent energy strength and tech weakness

- The last time Aramco was bigger than Apple was in 2020

Saudi Aramco overtook Apple Inc. as the world’s most valuable company, stoked by a surge in oil prices that is buoying the crude producer while adding to an inflation surge that is throttling demand for technology stocks.

Aramco traded near its highest level on record on Wednesday, with a market capitalization of about $2.43 trillion, surpassing that of Apple for the first time since 2020. The iPhone maker fell 4.4% in New York to $147.53, giving it a valuation of $2.38 trillion.

Even if the move proves short-lived and Apple retakes the top spot again, the role reversal underscores the power of major forces coursing through the global economy.

Soaring oil prices, while great for profits at Aramco, are exacerbating rising inflation that is forcing the Federal Reserve to rise interest rates at the fastest pace in decades. The higher rates go, the more investors discount the value of future revenue flows from tech companies and push down their stock prices.

“You can’t compare Apple to Saudi Aramco in terms of their businesses or fundamentals, but the outlook for the commodity space has improved. They’re the beneficiaries of inflation and tight supply,” said James Meyer, chief investment officer at Tower Bridge Advisors.

With the Fed on pace to further raise rates by at least another 150 basis points this year and with no prospects yet of a resolution for the conflict in Ukraine, it may be a while until tech regains dominance, according to Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder. “There’s panic selling in a lot of tech and other high-multiple names, and the money coming out of there seems headed in particular for energy, which for now has a favorable outlook, given commodity prices,” he said. “Companies like Aramco are benefitting significantly from this environment.”