Oil Output Slips as Higher Costs Hit U.S. Drillers

Oil Halts Slide as Fuel Stocks Plunge Ahead of Driving Season

- US distillate inventories fell to the lowest since May 2005

- New York gasoline inventories fell to lowest since 2017

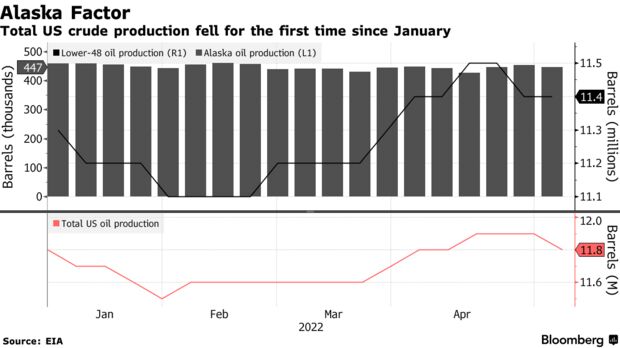

Weekly US crude oil production declined for the first time in three months, signaling that soaring costs across the oil fields may be preventing drillers from expanding output.

The decline hits as the oil-consuming nations are scrambling for additional supplies to reduce reliance on Russia and bring down the skyrocketing crude prices. President Joe Biden has urged the industry to raise supply to help battle historically high fuel inflation.

Bloomberg Crude oil price: WTI Crude105.18USD/bbl.+5.42+5.43%

In its Short-Term Energy Outlook report this week, the EIA lowered its production forecast through 2023. Drillers have said they are experiencing spiraling prices on everything from rigs and workers to diesel fuel and frack sand.

Oil rallied as the European Union continued to haggle with holdouts over a Russian crude ban while a US government report showed fuel inventories plunging ahead of the summer driving season.

West Texas Intermediate futures rebounded over $5 on Wednesday, halting a two-day slide in which futures shed more than $10. On Wednesday, Hungary said it will only agree to a ban on Russian imports if shipments via pipelines are excluded. In the US, the Energy Information Administration reported that distillate inventories fell to the lowest since May 2005.

Leave a Reply